Requirements Management in Banking and Finance Software Development

- Arunabh Satpathy

- July 13, 2023

- 9 minutes

Banking and financial software development are now some of the most consequential industries on the planet. In the United States alone, the insurance and financial services industry is 7.78% of the total GDP – almost $2 trillion (about $6,200 per person in the US).

Trends like artificial intelligence, blockchain, and digital transformation of companies into FinTech are intensifying competition. These companies must develop software for millions of users in a regulation-rich environment. Managing requirements is a crucial of software development, especially in finance. Poorly created software can expose companies to massive fines, dissatisfied customers, security disasters, and more, which makes requirements management more important than ever.

In the fast-paced world of banking, insurance, and finance, effective requirements management is crucial for success. Discover the essential best practices for software development in these industries and learn how they can benefit your company.

Related Articles

See how it works:

Ready to streamline your requirements management today?

1. The Status Quo

The banking, insurance, and financial services industries face many similar challenges. But they also have some important limitations.

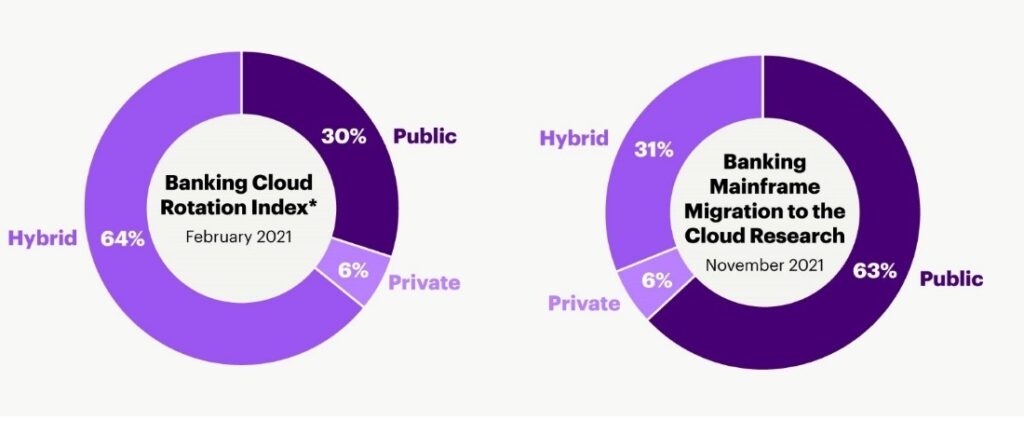

Historically, banks and insurance companies were hampered by big mainframes – large, centralized computers with green screens and simple interfaces. They were slow to change until roughly 10 years ago. Since then, competition in the banking sector in particular has meant that most banks are using web-based technologies alongside mainframes. They are also slowly but surely moving to the cloud.

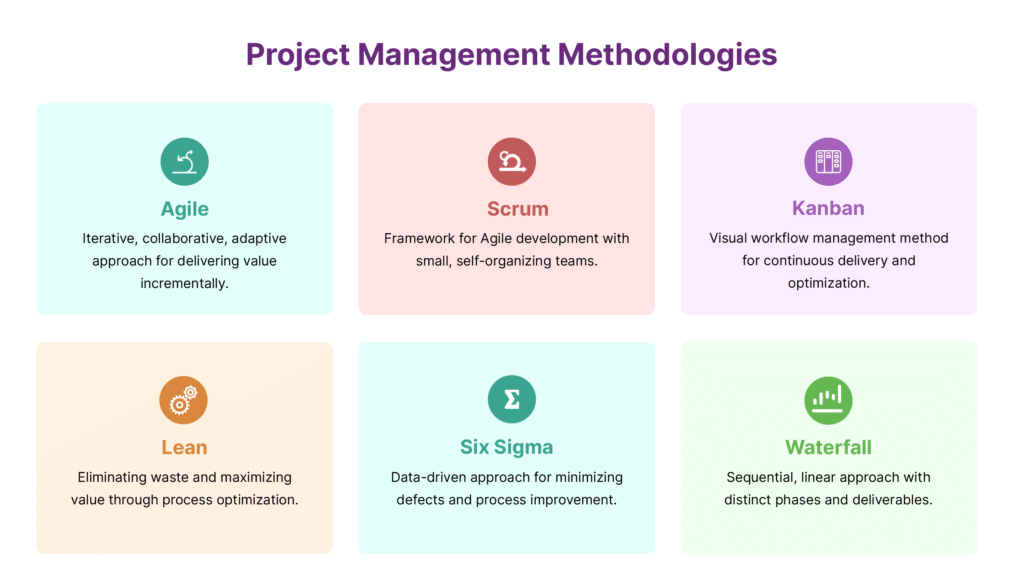

This shift necessitated that they switch to more modern project management methodologies like Agile. Some banks like Zions Bank, which used older tools until recently, now use more up-to-date tools to simplify and streamline their software development, including adopting DevOps practices.

Many organizations in this space are also using Commercial Off-The-Shelf (COTS) applications that serve industry-specific needs. These include payroll processing, enterprise resource planning (ERP), and customer relationship management (CRM) systems.

Ultimately, the adoption of these new technologies is to serve customers with better solutions. As a result, banking software development is increasingly driven by application lifecycle management and requirements management tools.

The insurance sector has lagged, by comparison. Insurance isn’t as agile because they don’t have as many client facing apps as banks. The insurance industry also has a lot of actuarial and manual work that doesn’t lend itself to new Agile frameworks.

Nine out of the world’s 10 largest insurance companies still use mainframes with decades-old policies. With backwards compatibility still a concern, when someone retires, it means that the companies must access the old backend.

Some newer and more forward-looking companies are now modernizing their mainframe infrastructure due to customer demands and market pressures. They’re also turning to newer methodologies for insurance product development. Accenture calls mainframes the last frontier in cloud migration.

2. Best Practices for Requirements Management

a. Flexible Methodologies

In a fast-changing environment, the finance industry needs to be flexible with project management methodologies because they provide a framework for managing change. This means adopting SAFe, Agile, Waterfall, Hybrid, and other methodologies based on the needs of the project. Older, mainframe-based projects may use Waterfall and a new web app project is better served with Agile.

There are many downloadable process templates like BABOK, Scrum-MR, Agile-MR, and more available online for these purposes.

b. Understanding Stakeholders

Most financial software development projects have multiple stakeholders to satisfy. Getting an explicit understanding of a company’s needs can involve surveys, focus groups, workshops, data analysis, requirements elicitation, and more. A good recent example of stakeholder engagement is Nestlé, who is researching ways to create a more sustainable cocoa value chain.

c. Gathering All Possible Requirements

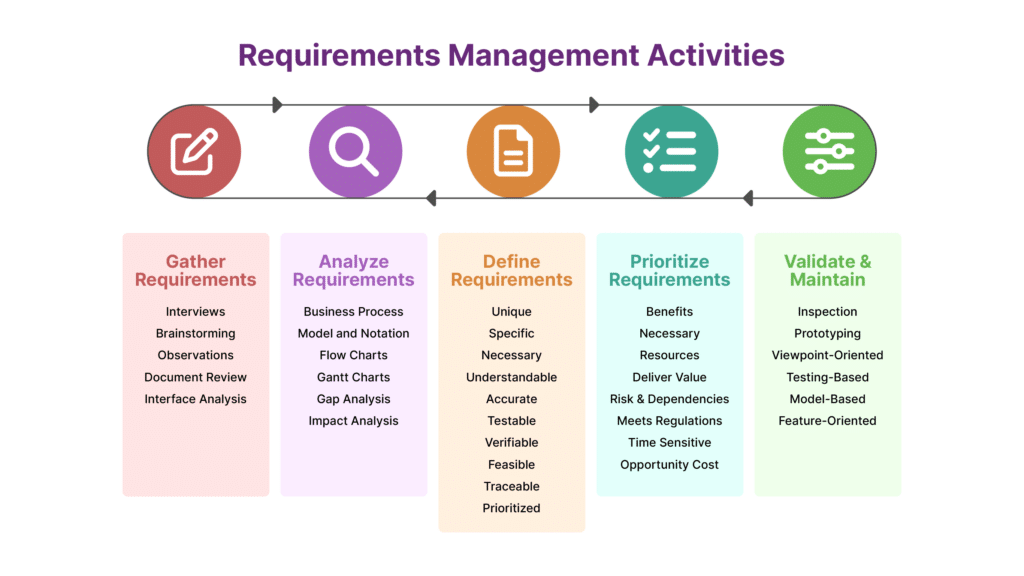

In our experience, the number of requirements within the project scope often tends to grow as a project moves forward. This means the use of many elicitation techniques and tools to gather all possible requirements from stakeholders. Techniques include surveys, focus groups, and more previously mentioned. Beyond this, you can use requirements elicitation tools like:

- AI-elicitation: After the rise of ChatGPT, the hype for artificial intelligence tools has spread to the requirements management industry. Some managers are even using ChatGPT itself as a requirements gathering

But ultimately, you need a dedicated artificial intelligence tool customized to the needs of requirements management. There are only a few tools currently available on the market with these features. - Documentation tools: One of the most natural ways to gather requirements is to throw them into a document. Using documentation tools that can properly format your requirements is critical to gathering and organizing requirements for software development.

- FAQs: By using a repository of questions to ask customers, your team can be confident that any team member can engage with stakeholders in an effective manner. A repository can also help you reuse some of the requirements and questions; saving time and money.

- Misc tools: There are several other tools you can use, like freehand note taking, diagramming, and requirements gathering from email exchanges and centralizing them.

d. Proper Reviews and Approval

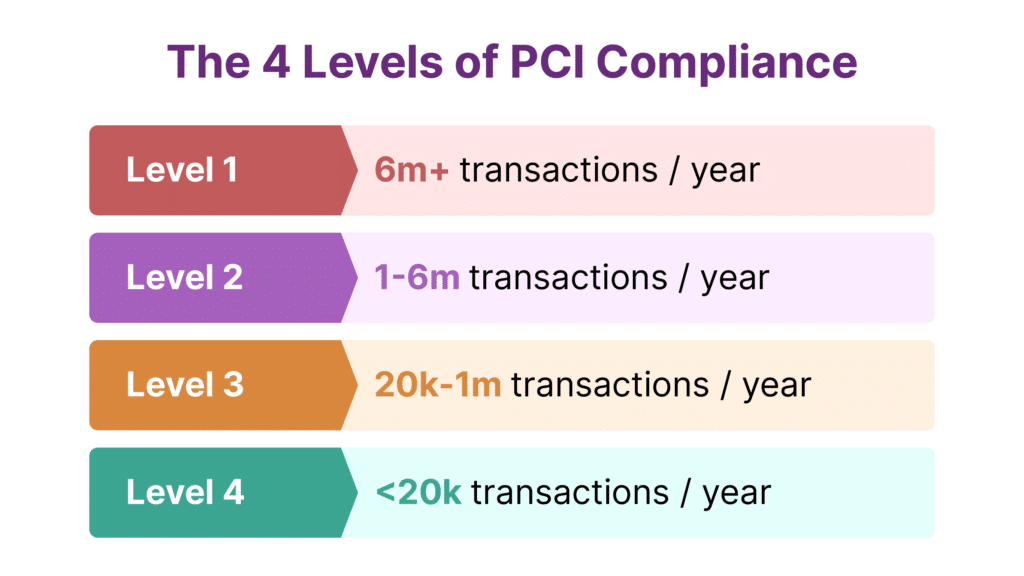

Most products released today undergo multiple revisions before and after they are released. Your team should conduct regular reviews and validations of requirements to ensure your ongoing projects are aligned with stakeholder and business requirements. For instance, a new credit card product must comply with the Payment Card Industry Data Security Standard (PCI DSS). The PCI DSS requires financial institutions that process credit card payments to comply with stringent security standards.

Not doing so can lead to dissatisfied customers, data breaches, and millions of dollars in lawsuits. A famous example is Heartland Systems, which suffered a $170 million loss due to a PCI DSS-related breach.

e. Traceability

In large, interconnected projects with thousands of requirements, not linking different requirements can lead to costly reworks, quality gaps, compliance issues, and much more. Tools like traceability matrices help you identify missing requirements and facilitate 100% test coverage confirmation and optimize QA efforts.

f. Risk Analysis

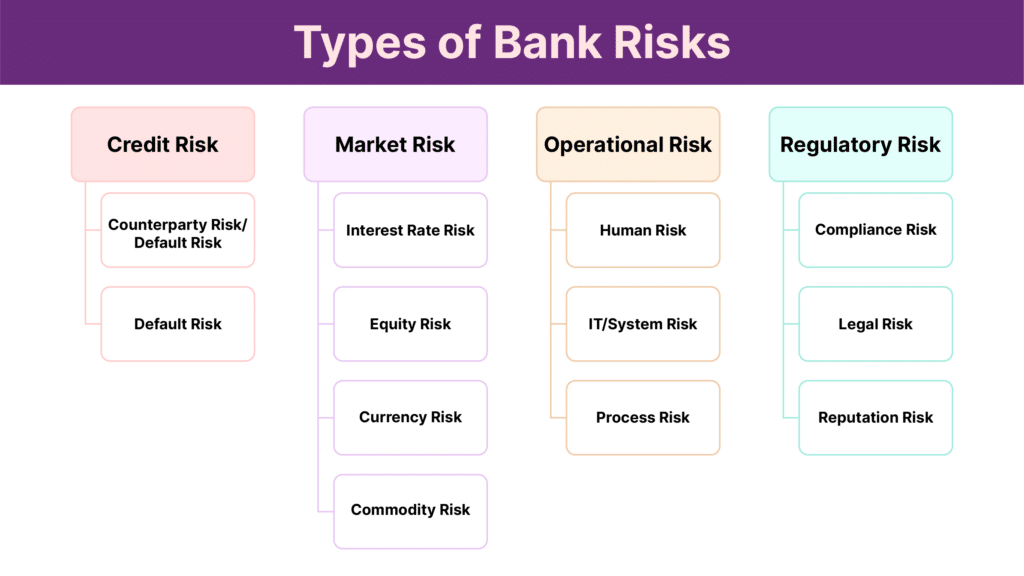

Risk management is how companies identify, analyze, and control risks to their business, customers, and stakeholders. In the case of the finance industry, companies may use credit risk mitigation strategies, guarantees, programs, as well as internal tools like interviews and focus groups.

Other than these methods, requirements management tools help them control risk through features like Smart Docs, baselining, reuse, traceability, and MatCal. Project managers can also perform impact assessment on specific requirements to check if other requirements are affected upstream and downstream.

3. The Future of Banking and Financial Software Development

Managing requirements effectively is crucial in software development for banking, finance, and insurance companies. In a competitive market, using certain best practices and the right tools means that companies can mitigate risk, improve efficiency, and deliver high-quality software solutions to customers in a regulation-rich environment.

By embracing modern requirements management practices and tools; banks, insurers, and financial services firms can navigate the fast-changing competitive landscape successfully.